are union dues tax deductible in canada

Union dues and professional association fees are tax deductible. Union dues and professional association fees are tax deductible.

How To Claim Union Dues On The Tax Return Filing Taxes

However if the taxpayer is self.

. You can claim these amounts for a tax. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can. Taxation of Union Dues.

Learn about claiming your annual professional or union dues on your income tax return to lower your taxable income and reduce your tax burden. Union dues are set by the bargaining agents and calculated either by using a fixed rate or as a percentage of the employees salary. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even.

Line 21200 was line 212 before tax year 2019. For example if your annual income is 40000 and you paid 1000 as union dues your taxable. In other words union dues offer no tax benefitthough some employees may itemize them as after-tax deductions when filing their annual returns.

Annual dues for membership in a trade union or an association of public. Tax reform changed the rules of union due deductions. If you belong to a union or professional organization you can deduct certain types of union dues or professional membership fees.

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. However if the taxpayer is self. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions.

However if the taxpayer is self. Tax reform changed the rules of union due deductions. 465 65 votes.

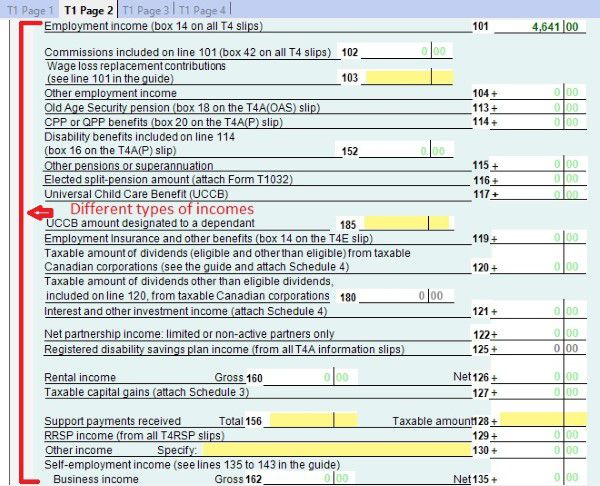

The general rule for claiming such a deduction is described in the annual income tax return guide. Are union dues tax deductible in Canada. You can deduct any union dues paid by you from your taxable income.

Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. At 15 per cent of total earnings MoveUPs dues are lower.

At 15 per cent of total earnings MoveUPs dues are lower than most Canadian unions. If the CRA asks for proof of which union your dues were paid to contact the payroll department of your employer and request a brief letter stating that they remitted the dues to MoveUP in 2013. However if the taxpayer is self.

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. What does the employer do with the union. Where do I put professional fees on tax return.

Line 212 Claim the total of the following amounts related to your employment that you paid. Annual dues for membership in a trade union or an association. Are union dues tax.

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. However if the taxpayer is self. However if the taxpayer is self.

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions.

Understand Your Payslips And Get The Right Pay In The Uk Understanding Yourself National Insurance Number Understanding

Different Types Of Payroll Deductions Gusto

Taxable Benefits Explained By A Canadian Tax Lawyer

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

6 Overlooked Tax Deductions And Credits That Could Score You A Big Return National Globalnews Ca

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Do Small Business Tax Deductions Business Tax Small Business Tax

Browse Our Example Of Cash Payment Voucher Template For Free Voucher Templates Payment

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca

Union Professional And Other Dues For Medical Residents Md Tax

Tax Course 8 Understand Individual Income Tax Return

How To Claim Union Dues On The Tax Return Filing Taxes

Browse Our Example Of Cash Payment Voucher Template For Free Voucher Templates Payment

4 Important Tax Rules For Holiday Parties And Gift Giving In 2021

2020 Year End Tax Tips For Canadians Cloudtax Simple Tax Application