how much will my credit score increase with a car loan

Getting a car loan might also diversify your credit mix the types of credit you have which can improve your credit score. Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer.

/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

New Credit Scores Take Effect Immediately.

. If you make payments on time your credit score will grow. FICO Scores and VantageScores. Both consider similar factors when determining your score though they weigh these factors.

If you need help finding the best auto. Because a portion of your credit score is derived from credit mix getting a car loan may help your credit profile if you dont already have an installment loan. From my own experience paying off several auto loans whenever I.

Throughout your life you build a credit score which can change over time. When you make payments on time it. I worked 38 hours.

How long after paying off a car loan does credit improve. The credit application you fill out for a car loan can temporarily lower your credit score usually by fewer than five points according to the MyFICO website. There are a few credit scoring models out there but FICO is usually.

Answered on Dec 15 2021. Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer. Building your credit score above 780 puts you into the superprime range which means you can get the best rates.

Your score will increase as it satisfies all of the factors the. Experts have stated that your credit score will begin to improve within just a few months after paying off your car loan. My Chrysler capital car loan reported a increase in balance.

Normal weeks my service tips are around 200-300. Those with lower credit scores will generally be required to. Learn More.

While a car loan paid on-time will ultimately help increase your credit score its a long-term plan that needs your full commitment. So I got a ding of almost 12 points on my credit report my credit lines are close as debt to income is high. How applying for a new auto loan will impact your credit score.

Paying off a car loan can allow more breathing space by reducing your. When you visit a dealer and decide to purchase a car fill out the loan paperwork and give the dealer permission. Answered on Dec 13 2021.

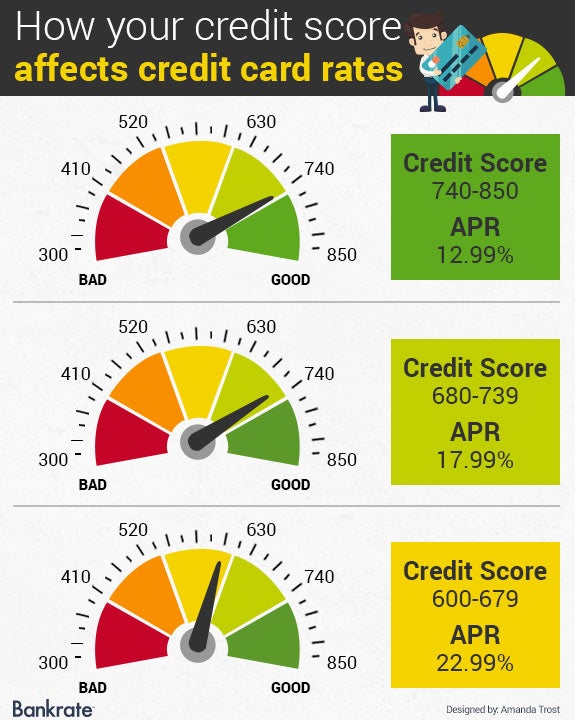

Those with lower credit scores will be faced with higher interest rates. In the second quarter of 2020 people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657 according to the. Eva has a mortgage loan and car loan.

100038261541 x 15 ot gives me the 62 and hour OT. Your credit score is higher. Your credit score may also affect your down payment amount.

The important thing to note is that she has a busy credit profile but pays on time. The good news is financing a car will build credit. Whenever you apply for new credit such as a car.

Your credit score is a number between 300 and 850 on the FICO scale which is the most commonly used credit scoring model used by auto lenders. As you make on-time loan payments an auto loan will improve your credit score. Youre not alonemany people with car loans question when to pay it off.

There are two types of credit scores. Ad You Can Increase your Credit Scores for Free only at Experian. It augments your payment history raises your total amount owed adds another figure to your average credit age and contributes an additional credit type to your portfolio.

Lenders usually decide upon loan approval based on your credit score. How Much Will Your Credit Score Increase. This week they were a little over 1000 due to two buyouts.

If you already have a credit score in. Length of credit history. Here is how its calculated.

Unfortunately when you first pay off your car your credit score will slightly go down and will not increase. Credit scores range from 300 to 850 the higher the better. Your payment history makes up a very large portion of your credit mix.

In a nutshell the FICO credit scoring formula the most commonly used scoring. Heres our breakdown of how to get a high credit score. If you increase your credit score significantly in the 12 months or so after taking out a car loan you may qualify for loan offers with better interest.

Free Credit Monitoring and Alerts Included. My credit score before paying off my car was 790. How much your credit score will increase is determined by your starting point.

There are five factors that. Generally speaking when you pay off a car loan or lease your credit score will take a mild hit. If a payment is late its recorded as 30 60 90 or 120 days late.

What Does Your Credit Or Cibil Score Say About You Improve Your Credit Score Good Credit Score Free Credit Score Check

What S The Minimum Credit Score For A Car Loan Credit Karma

What S The Minimum Credit Score For A Car Loan Credit Karma

Credit Score Needed To Buy A Car In 2021 Lexington Law

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Loan Rates

Do You Have Bad Credit Maritime Car Loan Offers Car Loans For Bad Credit In Nova Scotia Ge Bad Credit Personal Loans Loans For Bad Credit Bad Credit Car Loan

Average Auto Loan Interest Rates 2017 Facts Figures Valuepenguin Loan Interest Rates Car Loans Loan Rates

What Credit Score Is Needed To Buy A Car Lendingtree

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Credit Repair

Does Financing A Car Build Credit

How To Increase A Credit Score To 800 5 Proven Tips Credit Repair Business Credit Repair Improve Credit Score

Credit Score Your Number Determines Your Cost To Borrow

Pin By The Frugal Biddy On The Frugal Biddy Credit Score What Is Credit Score Improve Credit Score

What Credit Score Do You Need To Get A Car Loan

Decoding The Factors That Determine Your Credit Score Infographic Daily Infographic Credit Score Infographic Good Credit Credit Repair

Purchasing A New Car Car Loans Bad Credit Car Loan Car Finance

Today We Take A Look At The Difference Good Credit Vs Bad Credit Can Make Bad Credit Can Still Get You Appro Credit Repair Good Credit Credit Repair Services